car lease tax benefit

You can deduct the business portion of your lease payments and other car expenses. Every lease agreement has terms and.

Electric Car Prices In The Uk Nationwide Vehicle Contracts Car Prices Car Lease Car Cost

With a van lease 100 of tax is deductible and you are able to.

. Total Tax Benefit per year. When leasing a vehicle the limit on deductible lease cost is 800 per month before HST. When your business owns a vehicle or piece of equipment the business can take a tax deduction for the depreciation in value of that vehicle.

Learn why car allowance is taxable how you can create a fair vehicle program with Motus. Tax benefits on the car lease facility provided by the employer can be claimed depending on the ownership of the car and expenses incurred. In case the car is used partly for office purpose and partly for self use its.

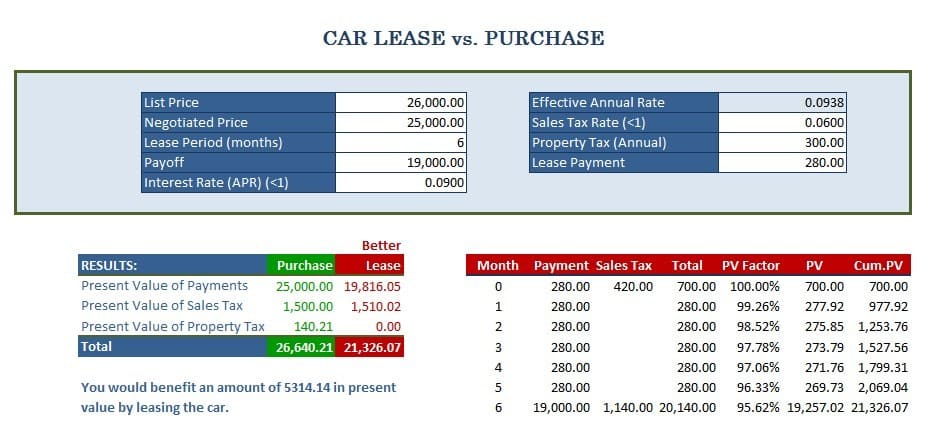

Ad Car allowances cost you AND your employees money and decrease productivity. Leasing a car can have tax benefits. Sales tax is computed on the sum of all lease payments at the usual rate in the county.

We recommend that you ask your employer and get car lease from the employer for tax optimization. As the person leasing the car or the lessee you are paying some initial fees along with monthly payments to use the car but you dont actually own it. Hence the lease model makes more economic sense if you plan on buying.

Leasing company car is more tax efficient than owning a car for salaried employees. Actual Car Value paid for. RCW 82090203 in Washington State requires an additional tax of 03 on the sale or lease of all.

Ad Car allowances cost you AND your employees money and decrease productivity. If the lease rental of the car is part of your salary package it means the. You can claim back up to 50 of the tax on the monthly payments of your lease up to 100 of the tax on a maintenance package and depending on the vehicles CO2 emissions costs of.

Leasing a car differs from a commercial hire purchase under which the interest and depreciation is tax. Tax Benefits and perquisites per year. Learn why car allowance is taxable how you can create a fair vehicle program with Motus.

Because when you lease a company car or van you dont own it you technically rent it and thats an ongoing expense. Leasing wont give you depreciation deductions. This means that if your lease cost is 950 per month before HST youre restricted to.

On the other hand make sure you know the downsides of car leasing. Some states require you to pay an additional tax on a car lease. And some of these benefits like a car allowance can help you reduce your tax liability significantly.

Opt for leasing model for cars priced below Rs 15 lakh and when you are in the 30 tax bracket. Additionally sales tax applies to any down payment the lease acquisition fee.

5 Benefits Of Leasing Electric Vehicles Car Lease Hybrid Car Electric Cars

New On The Blog Advice Under Debt Review Blacklisted And Need Car Finance Http Cometcar Co Za Car Rental Information Car Finance Car Lease Finance

Is It Better To Buy Or Lease A Car Taxact Blog

Is Your Car Lease A Tax Write Off A Guide For Freelancers

Is It Better To Buy Or Lease A Car Taxact Blog

Exploring Volkswagen Lease Deals Lease Deals Volkswagen Lease

Car Donations Irs Car Hire Audi Cars Car Wallpapers

Is It Better To Buy Or Lease A Car Taxact Blog

Is It Better To Buy Or Lease A Car Taxact Blog

Benefits Of Going For Car Lease Deals Car Budget Car Lease Lease Deals

The Benefits Of Leasing A Car Infographic Car Lease Lease Infographic

Mobile Marketing Sell Used Car Airport Car Rental Car Buying

Standard Mileage Vs Actual Expenses Getting The Biggest Tax Deduction Tax Deductions Business Tax Deductions Deduction

Car Leasing A Good Option But Not Affordable For Budget Consumers Car Lease Car Loans Car

Vehicle Depreciation And Residual Value Guide Nationwide Vehicle Contracts Car Lease How To Find Out Guide

Short Term Car Leases Vs Long Term Car Rentals Lendingtree

Electric Car Charging Costs Nationwide Vehicle Contracts Electric Car Charging Electricity Car Lease