sales tax calculator el paso tx

Application Fee - 3300. The median property tax in El Paso County Texas is 2126 per year for a home worth the median value of 101800.

Using Excel For Tax Calcs Jun 2019 Youtube

Sales Tax State Local Sales Tax on Food.

. Calculator for Sales Tax in the El Paso. The average sales tax rate in Arkansas is 8551. The Texas sales tax rate is currently.

625 percent Sales Tax will be based on either the Bill of Sale or the vehicles Standard Presumptive Value whichever is the higher amount. El Paso collects the maximum legal local sales tax. Anton Hockley Co 2110025020000.

Monument Live in Buy in. The El Paso sales tax rate is. The 825 sales tax rate in El Paso consists of 625 Texas state sales tax 05 El Paso County sales tax 1 El Paso tax and 05 Special tax.

Texas Comptroller of Public Accounts. The median property tax on a 10180000 house is 184258 in Texas. The minimum combined 2022 sales tax rate for El Paso Texas is.

As we all know there are different sales tax rates from state to city to your area and everything combined is the required tax rate. The Arkansas sales tax rate is 65 the sales tax rates in cities may differ from 65 to 11375. You can print a 825 sales tax table here.

The December 2020 total local sales tax rate was also 8250. Local tax rates in Texas range from 0125 to 2 making the sales tax range in Texas 6375 to 825. A county-wide sales tax rate of 05 is applicable to localities in El Paso County in addition to the 625 Texas sales tax.

Municipal Transit-Sun City Area Transit Tax. The base state sales tax rate in Texas is 625. All PPRTA is due if the address is located in El Paso County cities of Colorado Springs Manitou Springs Ramah Green Mountain Falls and Calhan.

TX Sales Tax Rate. El Paso Co Es Dis No2. Avalara provides supported pre-built integration.

Method to calculate El Paso sales tax in 2021. Use 20 Sales 35. Texas state sales tax rate range.

Texas Comptroller of Public Accounts. While many other states allow counties and other localities to collect a local option sales tax Texas does not permit local sales taxes to be collected. One of a suite of free online calculators provided by the team at iCalculator.

The County sales tax rate is. This calculator can only provide you with a rough estimate of your tax liabilities based on the property taxes collected on similar. The El Paso Texas Sales Tax Comparison Calculator allows you to compare Sales Tax between all locations in El Paso Texas in the USA using average Sales Tax Rates andor specific Tax Rates by locality within El Paso Texas.

Sales Tax Rate s c l sr. Standard fee for cars and lighter pick up trucks - 5075. The current total local sales tax rate in El Paso TX is 8250.

El Paso County Texas Sales Tax Rate 2022 Up to 825. The El Paso County Sales Tax is 05. The median property tax on a 10180000 house is 212762 in El Paso County.

City sales and use tax codes and rates. RE trans fee on median home over 13 yrs Auto sales taxes amortized over 6 years Annual Vehicle Property Taxes on 25K Car. Local taxing jurisdictions cities counties special purpose districts and transit authorities can also impose up to 2 percent sales and use tax for a maximum combined rate of 825 percent.

Texas sales tax rates vary depending on which county and city youre in which can make finding the right sales tax rate a headache. The December 2020 total local sales tax rate was also 8250. Real property tax on median home.

This is the total of state county and city sales tax rates. The current total local sales tax rate in Jourdanton TX is 8250. The base sales tax in Texas is 625You can also use Sales Tax calculator at the front page where you can fill in percentages by yourself.

Find your Texas combined state and local tax rate. The sales tax jurisdiction name is El Paso Ctd Transit which may refer to a local government division. US Sales Tax calculator Texas El Paso.

Base state sales tax rate 625. Counties cities and districts impose their own local taxes. The El Paso Texas sales tax is 625 the same as the Texas state sales tax.

The median property tax on a 10180000 house is 106890 in the United States. El Paso TX Sales Tax Rate. County- El Paso County.

PPRTA tax is not due if the address is located within the town limits of Fountain Monument or Palmer Lake. Municipal - City of El Paso. Ad Manage sales tax calculations and exemption compliance without leaving your ERP.

El Paso County collects on average 209 of a propertys assessed fair market value as property tax. Due to varying local sales tax rates we strongly recommend using our calculator below for the most accurate rates. Total rate range 6375825.

Choose city or other locality from El Paso below for local Sales Tax calculation. The El Paso Sales Tax is collected by the merchant on all qualifying sales made within El Paso. You can calculate Sales Tax manually using the formula or use the El Paso Sales Tax Calculator or compare Sales Tax between different locations within Texas using the Texas State Sales Tax Comparison Calculator.

Some cities and local governments in El Paso County collect additional local sales taxes which can be as high as 15. Get a quick rate range. Includes heavier pickup trucks 5400.

See how we can help improve your knowledge of Math Physics Tax Engineering. There is base sales tax by Texas. Local rate range 01252.

Total El Paso Sales and Use Tax. Texas imposes a 625 percent state sales and use tax on all retail sales leases and rentals of most goods as well as taxable services. Motor vehicles 6001-10000 lbs.

El Paso County has one of the highest median property taxes in the United States and is ranked 394th of the 3143 counties in order of median property taxes. Download all Texas sales tax rates by zip code.

Transfer Tax Calculator 2022 For All 50 States

How To Use Tax Function On Calculator Youtube

California Sales Tax Rates By City County 2022

Setting Up Tax Rates And Adjusting Tax Options

Texas Income Tax Calculator Smartasset

Setting Up Tax Rates And Adjusting Tax Options

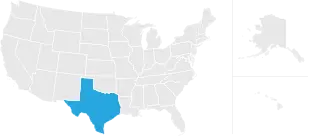

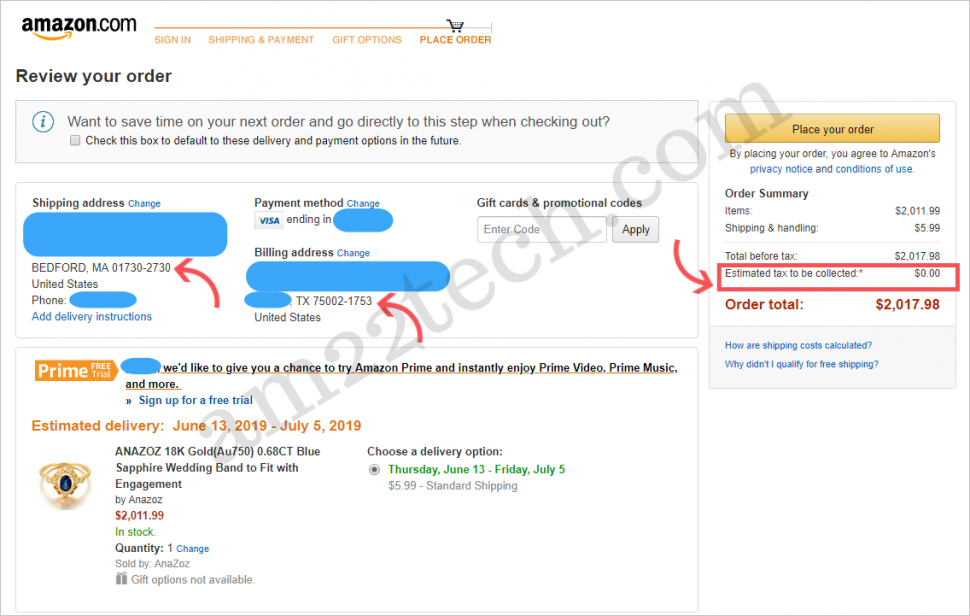

How To Avoid Sales Tax On Jewelry In Usa Buy Online Usa

Setting Up Tax Rates And Adjusting Tax Options

How To Avoid Sales Tax On Jewelry In Usa Buy Online Usa

Texas Sales Tax Small Business Guide Truic

Texas Used Car Sales Tax And Fees

Late Payment Interest Calculator For Past Due Invoices

Texas Sales Tax Guide And Calculator 2022 Taxjar

Figuring Cost Per Mile Owner Operator Independent Drivers Association Trucking Business Truck Driving Jobs Trucking Companies

Texas Income Tax Calculator Smartasset

How To Register For A Sales Tax Permit Taxjar

Texas Sales Tax Calculator Reverse Sales Dremployee

Pin On Cdl Pretrip Inspection Tips

Save 7 32 On Hp 17bii Financial Calculator Only 94 07 Financial Calculator Scientific Calculator Calculator